The profitability for suppliers chasing business in the global e-drives market has become “non-existent” as automakers bring more of the business in-house, said Liam Butterworth, the CEO of Dowlais, the parent company of GKN Automotive.

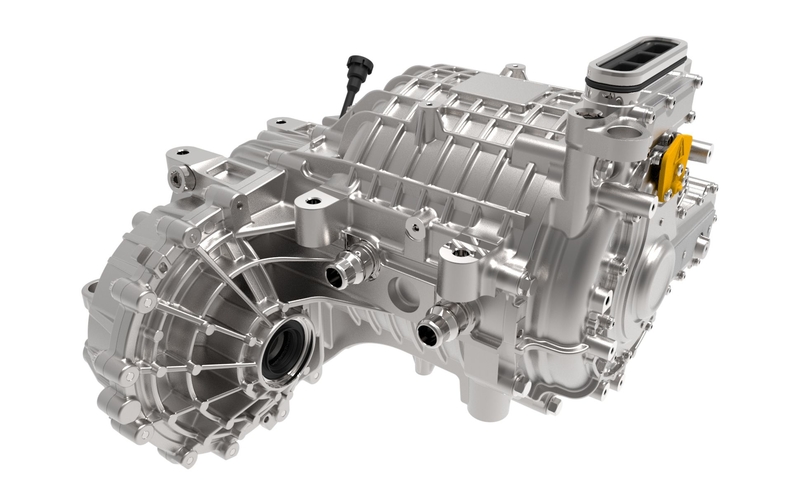

E-drives or e-axles package an electric motor, an inverter and a gearbox for electric cars, and they had been a key plank of GKN Automotive’s diversification plan to expand its core driveshaft business.

Automakers, however, are increasingly in-sourcing the production of e-drives to compensate for falling demand for combustion engines as EV growth continues. That is leaving less and less business for suppliers such as GKN, even as the overall EV market grows.

“What we see are automakers doing around 70 to 80 percent of those systems themselves in-house,” Butterworth told Automotive News Europe. “The remaining 20 percent that are going out to the market are in a very, very competitive environment.”

GKN Automotive has previously won key e-drive contracts including to supply the electric Fiat New 500, but has had to dial back plans to expand this element of the business, he said.

“We could grow the e-drive business significantly because we have the capability, but the profitability in the e-drive market is non-existent today,” Butterworth said.

Some e-drive suppliers are bidding low to “to compensate for a portfolio that is dying as a result of internal combustion engines" being phased out, Butterworth said, without naming the suppliers.

GKN Automotive’s core driveshaft product is used by both combustion engine vehicles and electric vehicles alike, meaning GKN can avoid participating in a bidding war to expand its e-drive business, Butterworth said.

U.K.-based Dowlais was spun off from Melrose Industries in April and includes GKN Automotive, GKN Powder Metallurgy and GKN Hydrogen.